Interview with Kimberly Carleson, CEO of US Beacon, Medical Billing Expert

“Steve is alive for a purpose and that purpose is for us to change healthcare. We believe it should be affordable and accessible.”

– Kimberly Carleson

Becoming an Advocate

In 2005, healthcare unexpectedly became incredibly personal to Kimberly Carleson. That year, Kimberly had a toddler-aged daughter and was pregnant with her son when her husband Steve received the life-altering diagnosis of Stage 4 metastatic cancer.

“When doctors told me that he had two years to live, I told them that they were fired. I found a doctor who was on my team,” Kimberly recounts. “I had to become his biggest advocate.”

Since Steve’s cancer had spread to his lymph nodes, initially physicians recommended that he begin chemotherapy but without any real hope for recovery. Although the family was based in Little Rock, Kimberly contacted major hospitals across the country in search of physicians willing to attempt to bring Steve into remission through intensive surgeries plus chemotherapy. The nearby University of Arkansas for Medical Sciences (UAMS), where Steve was a board member, answered the call.

“Our doctor told us that we were pulling a Hail Mary, and we were willing to do that. I knew that there just had to be a way,” she recalls.

Kimberly spent every night researching care regimens on blogs and tracking down people with relevant experience to speak with, even putting together a case that convinced his clinical team to change the type of chemotherapy that Steve received.

“I love physicians, but it is important to take control of your health. Be assertive,” she advises. “Be a name and not a number. It can make a huge difference.”

Treatment was brutal, but the Hail Mary attempts paid off, and Steve entered remission.

“My son just graduated high school and watching him with my husband by my side was one of the greatest moments of my life. What it could have been and what it was is because I fought,” Kimberly explains. “We were a name and not a number. No matter the hospital, you have to make sure that you are a name and not a number.”

Kimberly felt lucky that they could afford Steve’s treatment but got to know other UAMS patient-families who had to make unfortunate decisions because they could not afford care.

“We received a lot of hospital bills with charges that I did not understand. At the time I did not have the tools to review them, but I realized that not everything that we were billed was part of the treatment plan. When we were sitting in chemo rooms with other patients who could not do what we could afford, I realized that maybe there was something I could do to help them,” Kimberly recounts.

Before becoming a mom, Kimberly had been an X-ray technician and saw firsthand how patients really just wanted someone to reassure them. She had poured herself into fighting for Steve during his cancer but as his treatment miraculously succeeded, she realized that she wanted to fight for other patients too. Steve had spent his career with investment titan Merrill Lynch, and even while sick felt drawn to entrepreneurship, especially for an opportunity his wife was so passionate about. Together the couple decided to invest in, and then eventually fully purchase, medical billing review company US Beacon, where Kimberly is currently the CEO.

“Steve is alive for a purpose and that purpose is for us to change healthcare. We believe it should be affordable and accessible,” Kimberly commits.

De-Frauding Healthcare

The level of complexity within the American healthcare system provides an excellent opportunity for waste, errors, and fraud. If no one understands the system, no one is accountable or empowered to ensure integrity. This is apparent in medical billing.

In 1863, President Lincoln enacted the False Claims Act to protect taxpayer funds during the Civil War. Today, it is utilized to prevent and penalize Medicare and Medicaid fraud, and healthcare is consistently the industry with the most False Claims Act settlements annually. The Act imposes large financial penalties on anyone that intentionally defrauds the government by allowing whistleblowers to sue on behalf of the United States government, with the incentive that whistleblowers receive some of the settlement reward.

In a typical False Claims Act healthcare case, like this 2020 case, nurses and caseworkers become whistleblowers against a hospital chain with a pattern of overbilling Medicare and Medicaid for unnecessary or fraudulent services. While it is an imperfect mechanism, partly due its reliance on whistleblowers, the Act deters against defrauding government health insurance plans.

However, 165M Americans, or 60% of Americans younger than 65, are insured by employer-sponsored private health insurance. Employers began to offer health insurance to try to attract workers during a World War II-induced shortage, when President Roosevelt had implemented a wage freeze. Employer-sponsored insurance has emerged as one of the top defining characteristics of the American healthcare system. Since private, or commercial, health insurance is not government-funded, it is not protected by the False Claims Act.

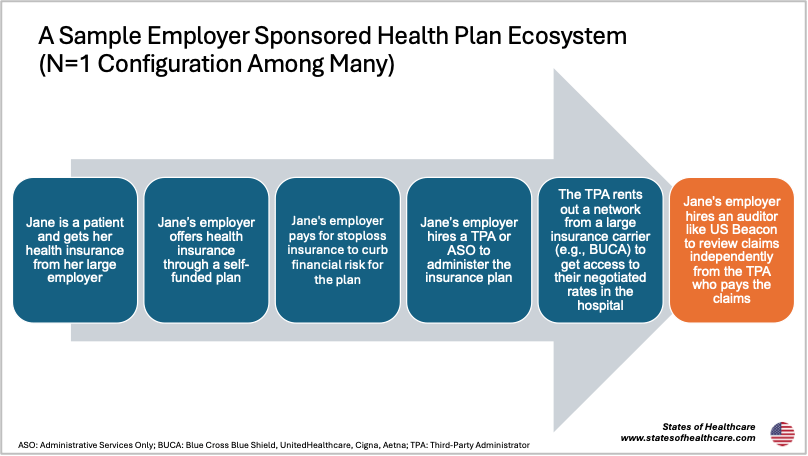

Employers can either purchase health benefits for their employees from an insurer (e.g., Cigna, Aetna) or pay for their employees’ health expenses directly, which is “self-funding.” There are some incentives for private companies to create self-funded plans since these are exempt from certain taxes and regulations. 63% of insured American workers have coverage through a plan that their employer self-funds.

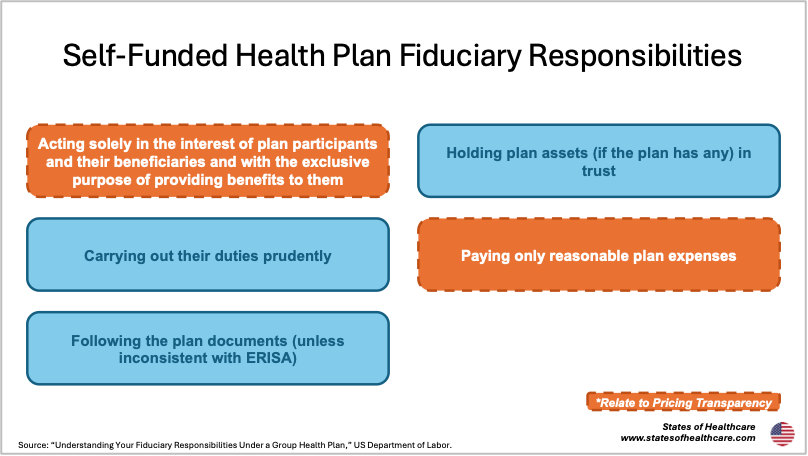

While it can be financially advantageous for employers to self-fund their health plan, this does not necessarily mean that they have the tools to negotiate with hospitals and physicians, process medical claims, and manage benefits. Third-Party Administrators (TPAs) and Administrative-Services Only (ASOs) offer these services to self-funded plans. However, it is important to note that even with these third parties administering the plans, employers who sponsor self-funded insurance are considered legal fiduciaries of the plan according to the Employee Retirement Income Security Act (ERISA).

As the ERISA fiduciary, employers that sponsor a self-funded plan are responsible for representing the best interests of the plan beneficiaries and paying reasonable expenses. But how can employers, who may or may not be equipped to understand the convoluted healthcare value chain, gauge whether they are acting in the best interest of their beneficiaries (aka their employees and their dependents)? And in a healthcare system where most pricing is kept confidential, how can they ensure that they are only paying reasonable expenses?

Many TPAs have a billing review system in place, but Kimberly notes that it is not ideal to have the same group reviewing and paying the bills since sometimes incentives can be misaligned. In May 2025, the Georgetown University Center on Health Insurance Reforms outlined how TPAs can inflate healthcare costs through certain contract tools, including revenue guarantees where the TPA might promise a network provider a certain minimum revenue volume annually regardless of the realized services.

Like many layers of the healthcare system, TPAs are also highly vertically integrated. Some of the most utilized TPAs are owned by larger health carriers, including UMR and Meritain Health which are owned by UnitedHealth Group and CVS Health respectively. Whether ownership affiliation affects decision-making by subsidiaries is a hotly debated topic in healthcare.

Kimberly’s company, US Beacon, is an independent medical bill reviewer that helps plans ensure that their medical bills comply with their fiduciary duty.

“We eliminate ineligible charges, overcharges, upcoding, and unbundling,” Kimberly explains. “For in-network bills, we typically find 30% ineligible charges for every claim. For a 5,000-member group, we typically save 10% of your overall spend. We have reviewed hundreds of thousands of claims and only found one clean claim with zero ineligible charges that was able to be paid as-is.”

Throughout her career, Kimberly has seen lots of waste, errors, and, arguably, fraud in medical bills. Her team typically focuses on bills greater than $10,000 where they find the most savings, which usually are hospital-based but can sometimes be outpatient. Kimberly has caught bills that represented stomachaches as Level 5 emergency room visits, the most severe rating for highly involved medical cases. She has also seen services, like the sterilization of the operating room, billed multiple times when they were already accounted for in a bundled billing code.

“We make sure everything in the bill is sound and defensible. Our appeal rate is less than 1%, and we have never lost an appeal,” she adds.

US Beacon leverages an in-house database tool that screens medical bills against relevant rules and regulations. If there are serious concerns with a bill, US Beacon will subcontract a doctor or nurse to provide input on medical necessity.

“The power is in the plans. It is your money, your data, your right to review your claims. The laws are in your favor, so take advantage. Do not let the same person paying your bills review your claims because that is like the fox guarding the henhouse, and it is not in the plan’s best interest,” she advises.

US Beacon also makes sure that savings get back to the patient. Kimberly’s team is hired by plans, but the patient remains at the center of her focus too.

Separate from US Beacon, but very much informed by her professional expertise, Kimberly also has taken on helping patients, many of whom she becomes connected with through LinkedIn, who are being denied care by their insurer.

“I have patients reach out to me all the time, and I help them because it is something I do. I know the laws, and I know not to back down,” she shares.

Recently, Kimberly helped a LinkedIn friend gain access to an autoimmune disease medication that her new insurance denied after the patient had already been on the medication for two years. The denial resulted in three ER visits, a hospital stay, multiple epilepsy seizures, and approximately $60,000 in excess medical claims costs. Kimberly convinced the insurer to appeal their decision, stemming from a denied prior authorization, in four days when the patient had been trying to obtain access for four months.

Right and Wrong

US Beacon primarily works for self-funded employer plans but also with government plans and other entities. Kimberly notes that working with government plans is more challenging.

In one instance, Kimberly answered a request for proposal (RFP) for a small state’s employee health plan. State employee health plans are tax-funded, commercially administered employer plans, making them an interesting case. Beneficiaries include anyone from public school teachers to state administrators. Using a prior year’s data, US Beacon found substantial errors, equating to 64% potential savings for the plan and worth millions of dollars.

“The first question asked by the Head of the Committee for the Department of Transformation was ‘what is the insurance carrier going to think about this?’” Kimberly recounts. “I don’t care what the carrier thinks. What will taxpayers think about saving millions a year?”

Ultimately the state chose to not contract with US Beacon as they were concerned it might harm their relationship with their health insurance carrier, who was also their TPA. The carrier insisted that it already had a review process in place, despite US Beacon’s findings (“Were they asleep or what?” Kimberly asks).

Separately, a lobbyist in the same state told Kimberly point blank that if US Beacon paid the lobbyist, they could get them the state plan contract. Kimberly was horrified.

“I believe in right and wrong, and it is just wrong. If I have to pay you to get in to do what is in the best interest of the state, I do not want to be involved in that,” she concludes.

Reputation is Everything in Arkansas

Kimberly’s penchant for patient advocacy and delineating right from wrong is grounded in her upbringing in Arkansas (population: 3.1M).

“When you are from a smaller town, I think you realize your reputation is so valuable. Reputation is everything in Arkansas because everyone knows you,” she explains.

Kimberly was born and raised in Hope, Arkansas (population: 8,600) in the southwest of the state, where her parents still live. Coincidentally Hope’s most famous resident was President Bill Clinton, whose birthplace there is now preserved as a National Historic Site.

“Small towns are becoming different now, but it was an ideal childhood. Our grandparents were nearby, we had land, and we played in creeks,” she recounts.

In 2024, Steward Health Care, owner of Wadley Regional Medical Center which is the only hospital in Hope, shuttered in bankruptcy. Pafford Health Systems, an ambulance company owned by a local family, purchased the hospital. In a normal situation, Kimberly notes that an ambulance company could really take advantage of owning the only hospital in a town like Hope, perhaps even airlifting patients unnecessarily. However, like many in Hope, Kimberly knows this family well and they have a reputation for being highly ethical. Patients in Hope are more insulated from a potential conflict of interest because no one wants to betray their neighbors or their long-held reputation. The hospital acquisition is not an ideal situation on paper, but community shines through.

Kimberly left Hope to attend the University of Arkansas, located in Fayetteville (population: 102,000) in the northwest of the state, where her daughter now attends, and her son is an incoming student. Later she moved to Little Rock (population: 204,000), the capital and largest city in the state, where she and Steve raised their family.

“Arkansas is a state where everyone tailgates for Razorback football games. It is a small state with huge love for the teams, the schools, and the people. I wouldn’t change it for anything, and I wouldn’t want to live anywhere else,” Kimberly commits.

Kimberly and her husband still live in Little Rock. Like in 2005, Kimberly again is advocating for Steve’s care at UAMS, this time as he awaits a kidney transplant. Like her previous diligence research on cancer blogs, Kimberly has recently connected with a top transplant physician through her LinkedIn community. Although it was an arduous process to get Steve on the UAMS kidney waitlist, she wanted to make sure he was in the best position possible for optimal care. The prominent transplant physician confirmed that nationally UAMS is one of his personal top recommended sites.

Steve and Kimberly have been called by UAMS for a possible kidney transplant once so far. It was not a match, so he maintains his spot on the waitlist.

“It’s a bittersweet moment to get the call. You want to feel overjoyed, but you also know that another family is grieving. The doctors at UAMS could have rushed to transplant the kidney into my husband, even if it meant risking complications and doing another transplant later, which would have been financially beneficial to them. But they didn’t. They prioritized what his body truly needed. That’s what it means to be treated as a name and not just a number,” Kimberly shares.

Like many small states with large rural swaths, including the Ozark and Ouachita Mountain regions, Arkansans sometimes feel underestimated by the rest of the country.

“Whether you like it or not, there are a lot of people who have come from this small state who have made huge impacts on the world,” Kimberly shares, calling out politicians Bill Clinton and Mike Huckabee and Walmart founder Sam Walton.

Famous Arkansan musical icons range from country musician Johnny Cash to R&B hit singer Ne-Yo to popular early aughts goth rock band Evanescence. Arkansas is also home to the only publicly accessible diamond mine in the country and Hot Springs National Park.

Although based in Arkansas, US Beacon operates in all fifty states. Kimberly has been threatened with lawsuits on several occasions when working in Northeastern states.

“I don’t back down. Just because I have a southern accent does not mean that I am not very capable of knowing the law,” Kimberly jokes.

Still, Kimberly thinks that regardless of inter-country cultural differences, America’s healthcare needs are broadly the same.

“Whether you are from Little Rock or Los Angeles, patients want to know what care costs before the bill arrives and want care decisions to be based on what is best for their health and not what is profitable for the system. It’s the same across the country. Employers want to protect their people; they want fairness,” she summarizes.

“Healthcare is a sinking ship in this nation, and if we don’t save it and pick up the pieces with reform, I can’t imagine what it will be like for our own children.”

Leave a comment